VANCOUVER, BC – February 4, 2021 - Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the "Company") is pleased to provide a review of its exploration activities from 2020 and a preview of its exploration plans for 2021. Concurrent with the development of the Camino Rojo Oxide Project, Orla will continue to advance its project pipeline and exploration in both Mexico and Panama. The Company is seeking to expand its reserve and resource base and make new discoveries through a systematic and efficient approach to exploration.

“Orla has large and highly prospective land packages, in two nations, that already host oxide and sulphide gold deposits. Both land packages are under-explored around the existing discoveries providing an outstanding opportunity for additional discoveries in the coming years,” stated Jason Simpson, President and Chief Executive Officer of Orla Mining.

Orla’s exploration work in 2021, during a construction year, will be modest and focused on supporting study work for existing deposits and new target identification. It can be classified in two categories:

- Near-Deposit: Exploration to support study and expansion of existing deposits.

- Regional Exploration: Activities to generate new discoveries.

2021 EXPLORATION PROGRAM SUMMARY:

Program | Objectives | 2021 Budget (US$M) |

Near-Deposit: Confirmatory oxide drilling (Camino Rojo) | Confirm and increase oxide mineralization from Fresnillo property | $0.5 |

Near-Deposit: Sulphide directional drilling (Camino Rojo) | Provide additional material for metallurgy, geotechnical and geological studies | $2.5 |

Regional Exploration | Define drill targets for satellite discoveries | $1.0 |

Total Mexico |

| $4.0 |

Near-Deposit: Caballito trend Quemita drilling | Discover more Cu-Au mineralization | $0.7 |

Regional Exploration | Define drill targets for satellite discoveries | $0.4 |

Total Panama |

| $1.1 |

Total Exploration Budget |

| $5.1 |

MEXICO (163,000 HECTARES)

The land package is under-explored and the proximity to the large Camino Rojo mineralized system, hosting 9.5 million ounces gold in measured and indicated gold resources (353 million tonnes at 0.83 g/t)[1], provides a highly prospective opportunity. Exploration on the project is somewhat challenged due to the presence of a thin alluvial soil and caliche cover impacting geochemical surface expressions, but the potential to discover mineralization is considered excellent.

Mexico 2020 Review

Near-Deposit Expansion

Program: A 6,000-metre oriented core drilling program began on the large sulphide resource at the Camino Rojo deposit in the fourth quarter of 2020 to generate additional information regarding the continuity and geometry of the higher-grade mineralization and provide new material for geotechnical and metallurgical studies.

Results: 1,960 metres of the drill program were completed in 2020. Assay results are pending for the first holes and drill assay results will be presented following the completion of the program in the second quarter of 2021.

Regional Exploration

Program: Completion of reverse circulation (“RC”) drilling totalling 5,212 metres at Las Miserias, San Tiburcio and Guanamero targets. The targets drilled as part of this campaign were previously identified during a first-phase geophysical induced polarization (“IP”) program on the Camino Rojo district.

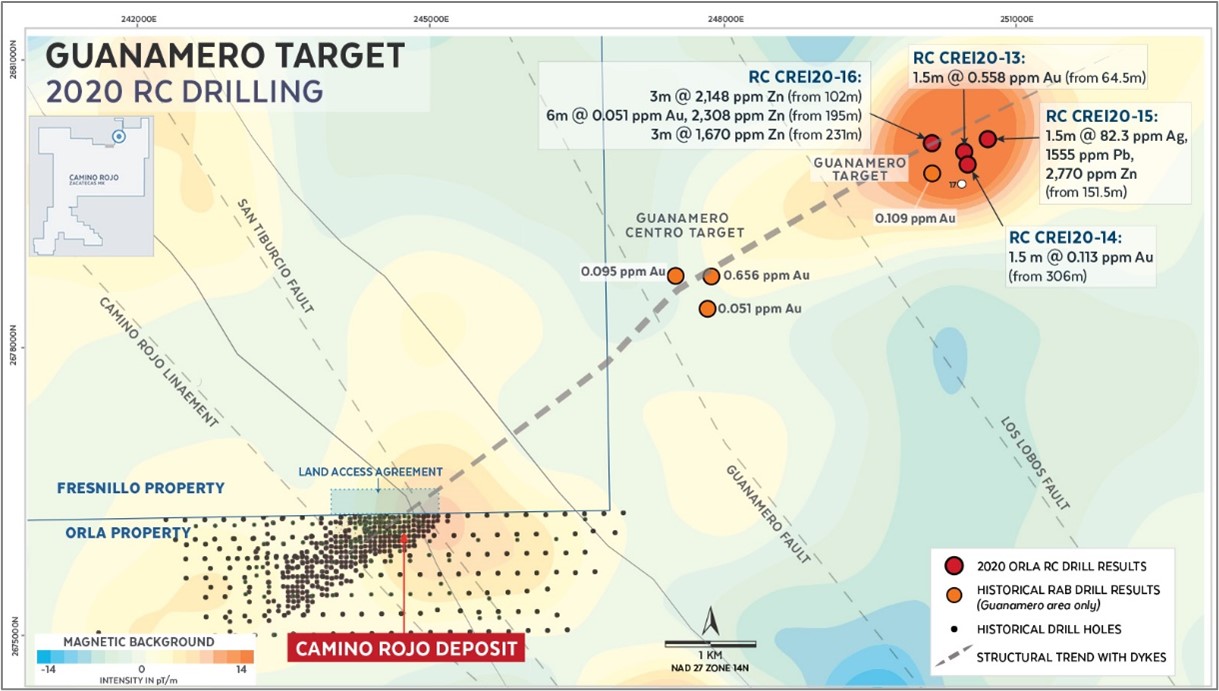

Results: Encouraging anomalous drill assay results (1.5m at >0.500 ppm Au, or 1.5m at > 50 ppm Ag, or 1.5m at > 1000 ppm Zn) were obtained approximately 7 kilometres to the northeast of the Camino Rojo deposit, along the same NE-SW structural trend interpreted to host the deposit (see Figure 1). Anomalous assay results are associated with faulting recrystallization, skarn alteration with disseminated pyrite, and sphalerite mineralization.

- 1.5m at 0.558 ppm Au, from 64.5m (RC hole CREI20-13)

- 3m at 2,148 ppm Zn, from 102m, 6m at 0.051 ppm Au, 2,308 ppm Zn, from 195m and 3m at 1,670 ppm Zn, from 231m (RC hole CREI20-16)

- 1.5m at 82.3 ppm Ag, 1555 ppm Pb, 2770 ppm Zn, from 151.5m (RC hole CREI20-15)

- The drilling also intersected numerous intermediate composition dykes ranging from less than 1 metre and up to 63 metres (down holes intervals), similar in composition to the dyke found within the core of the Camino Rojo deposit.

Figure 1: Guanamero, Mexico Target 2020 RC Drilling

Program: Mechanical trenching totalling 140 metres excavated nine trenches at the Las Miserias target.

Results: Exposure of zones of strong alteration and silicified breccias associated with NW-SE and NE-SW oriented structures with widths up to 40 metres. The host rock is the Caracol and Indidura formations, the same geological units hosting the Camino Rojo deposit.

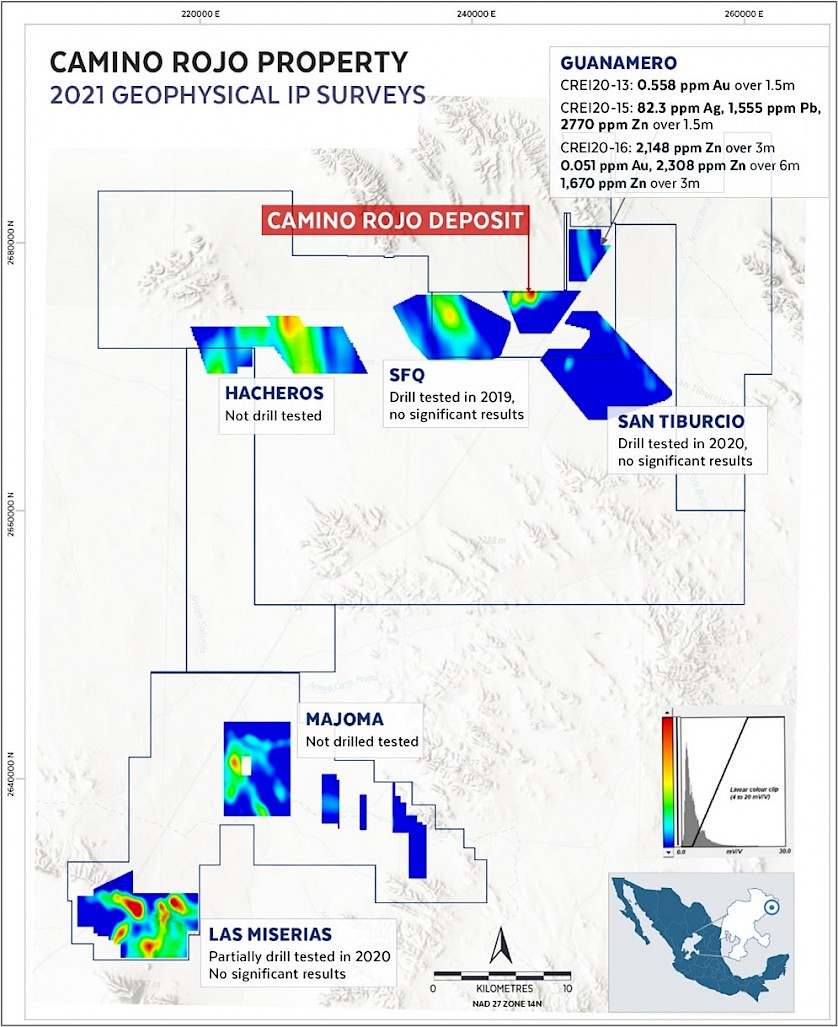

Program: Geophysical IP surveys over a 233-kilometre line across four target areas: Las Miserias, Majoma, Hacheros, and Guanamero (see Figure 2). The most significant chargeability anomalies were defined at Las Miserias and Hacheros.

Figure 2: Camino Rojo 2021 Geophysical IP Surveys

Mexico 2021 Preview

Near-Deposit Expansion

Program: Camino Rojo Sulphides

Completion of a directional drilling program that commenced in the fourth quarter of 2020. The program consists of close-spaced, 25-metre drilling of the sulphide zone, over the down plunge extension of the Camino Rojo deposit.

Objective: The new information collected will support development scenario planning for the large sulphide resource which hosts 7.3 million ounces of gold in measured and indicated resource categories (256 million tonnes at 0.88 g/t)[2]. The drilling will provide additional information about the continuity and geometry of the higher-grade mineralization and provide new material for geotechnical and metallurgical studies.

Program: Camino Rojo Oxides

Completion of a 2,500-metre core drilling program on Fresnillo’s property and integration of Orla’s geological and resource models with Fresnillo’s drill data.[3]

Objective: Enable material on the Fresnillo concession to be included in the measured and indicated mineral resource categories and to be considered in an updated mineral reserve estimate.

Regional Exploration

Program: Completion of a 7,500-metre rotary (“RAB”) Covered Bedrock Interface (“CBI”) survey.

Objective: The 2021 regional program will seek to define drill targets for the discovery of satellite deposits near the Camino Rojo deposit. A large part of the property has a thin cover of alluvial soil and calcrete or caliche layers (calcium carbonate concretions). The resulting geochemical samples from the survey in combination with geophysical IP surveys planned in 2021 and existing geological information will allow for the definition of new priority drill targets.

PANAMA (14,893 HECTARES)

The discovery of the Caballito mineralized zone and follow-up drilling executed by Orla led to the definition of significant copper and gold sulphide mineralization with open pit potential. The Caballito-style mineralization differs from the Pava and Quemita oxide deposits as it consists of copper-gold (low arsenic) sulphide mineralization that will not be amenable to heap leaching and will require a different processing method. The Cerro Quema property shows some potential for additional oxide mineralization, and the upside resides within the sulphides in an area that is largely under-explored.

PANAMA 2020 REVIEW

Near-Deposit Expansion

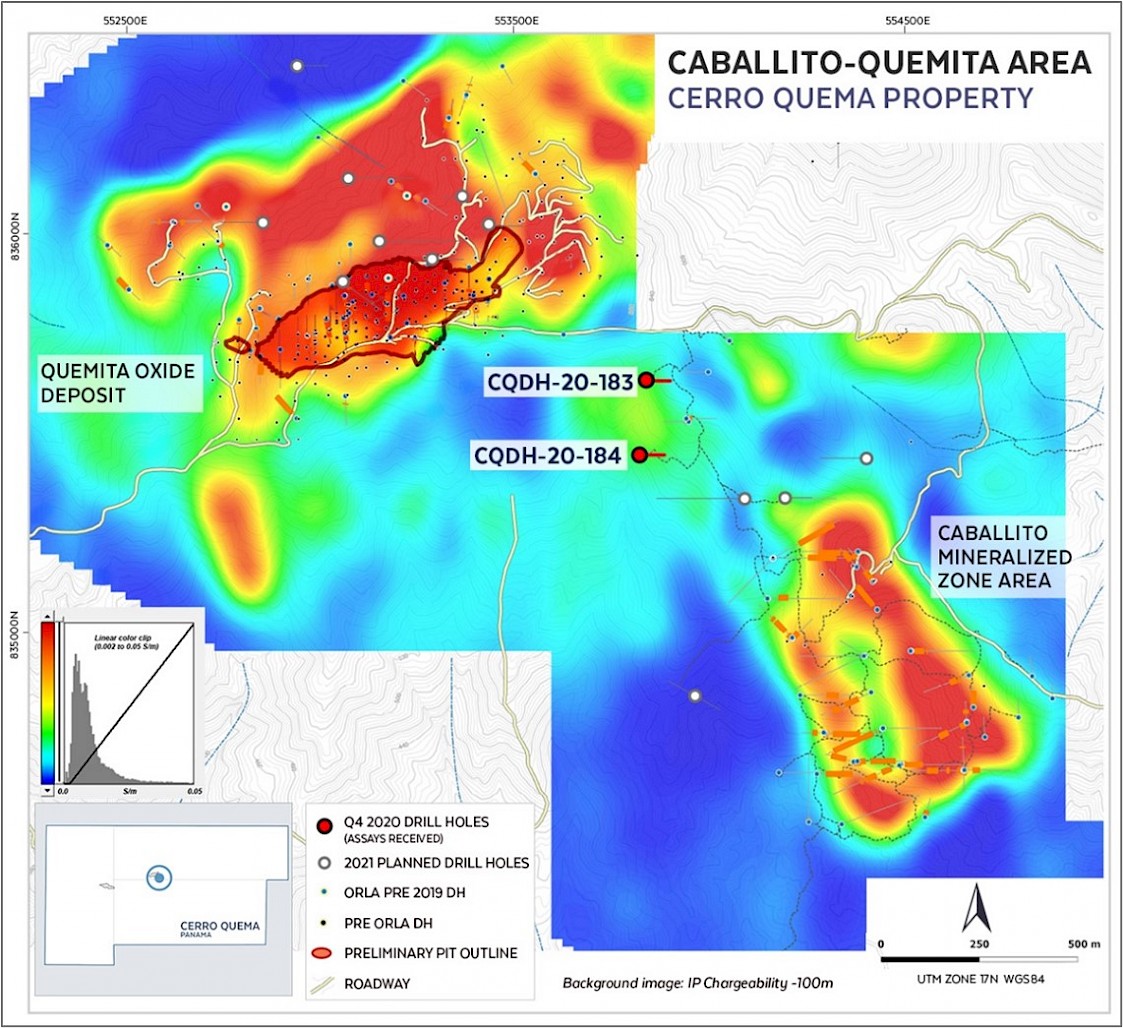

Program: In the fourth quarter of 2020, drilling commenced along the Caballito trend to define additional copper-gold sulphide mineralization like the previously discovered Caballito mineralized zone.

Results: In the first two of 15 planned holes completed (see Figure 3), multiple intervals of alteration were noted. This included narrow intervals of weakly to moderately advanced argillic alteration and patchy quartz-alunite intervals and mineralization mostly disseminated pyrite and local pyrite-enargite and trace of copper sulphide. Anomalous assays (1.5m at > 0.500 ppm Au, or 1.5m at > 1,000 ppm Cu) included gold and copper with values up to 0.538 ppm Au and 2,400 ppm Cu over 1.5 metres from 344.3 metres in hole CQDH-20-184.

PANAMA 2021 PREVIEW

Near-Deposit Expansion

Program: Cerro Quema Caballito Trend – Quemita

Completion of a 15-hole, 3,760-metre drill program that began in the fourth quarter of 2020 and will extend into the first half of 2021.

Objective: Testing priority targets primarily defined with geophysical IP anomalies along the Caballito trend, outside the Caballito deposit, and near the Quemita deposit. The aim of the drill program is to assess the copper-gold upside potential to the current mineralization.

Figure 3: Caballito-Quemita Area Drill Program (Near-Deposit)

Regional Exploration

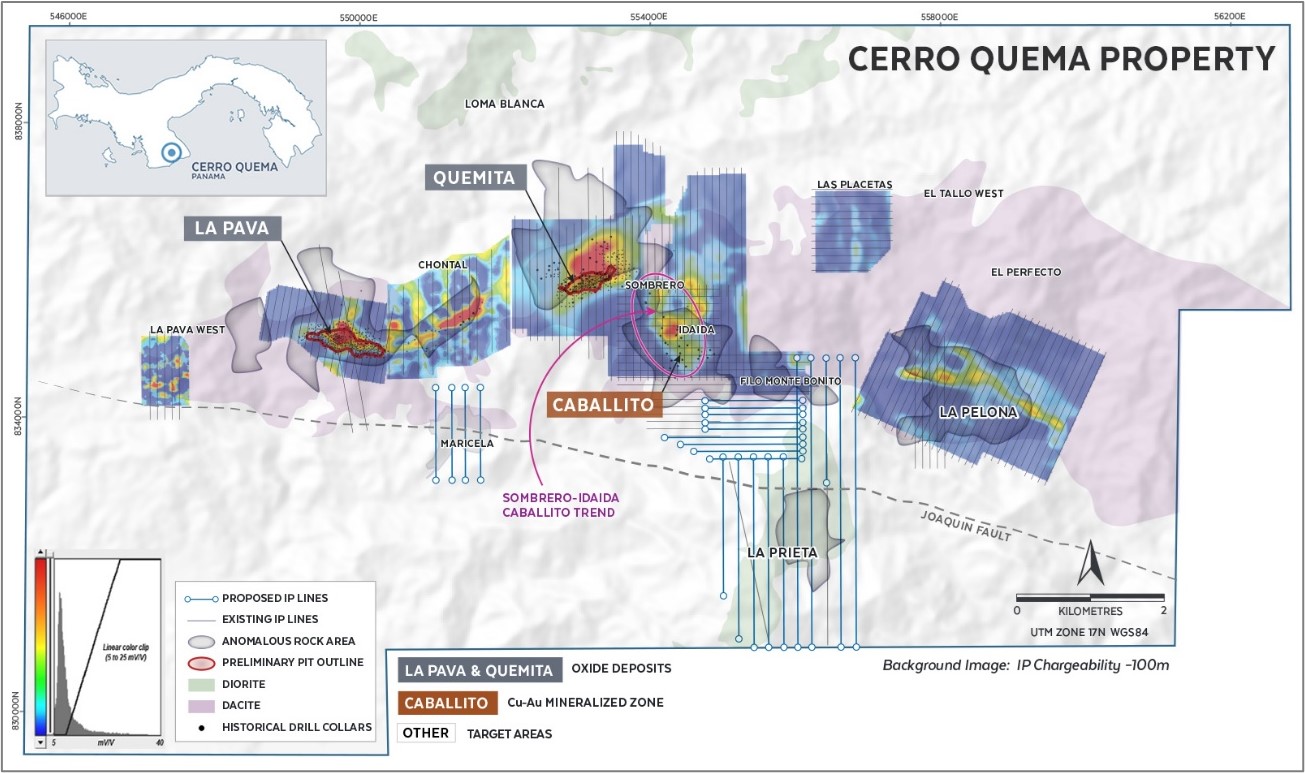

Program: Completion of a geophysical IP survey totalling 50-kilometres will be performed on the southeast extension of the Caballito deposit and the La Prieta target area located farther to the south (see Figure 4).

Objective: The new geophysical information obtained will be combined with a global review of the Cerro Quema data to define new drill targets for the discovery of Caballito-style satellite deposits. At La Prieta, porphyry-style mineralization is outcropping, and historical reconnaissance geophysical IP lines indicate a large chargeability anomaly over this area. Follow-up IP survey will further define the extent of this target and will assist with the definition of drill holes.

Figure 4: Cerro Quema Geophysical IP Survey

Drill Results: All intercept widths are down hole intervals. There is insufficient geologic data to interpret true widths of mineralized intersections. Drill results available at https://www.orlamining.com/site/assets/files/5434/camino_rojo_results_02_04_2021.pdf and https://www.orlamining.com/site/assets/files/5435/cerro_quema_results_02_04_2021.pdf.

Qualified Persons Statement

The scientific and technical information related to Cerro Quema and Camino Rojo in this presentation has been reviewed and approved by Mr. Sylvain Guerard, P Geo., who is the Qualified Person for this news release as defined under the definitions of National Instrument 43-101 (“NI 43-101”).

Quality Control Protocols

Cerro Quema: All gold results were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver and copper, using an Aqua Regia (ME-ICP41) method at ALS Laboratories in Peru. Samples with copper values in excess of 1% by ICP analysis are re-run with Cu AA46 aqua regia and atomic absorption analysis. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with National Instrument ("NI") 43-101 and industry best practices. Standards, blanks and duplicates are included approximately one every 25 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to a secondary laboratory for check assays. The HQ diameter core is halved with a diamond saw.

Camino Rojo: All gold results were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver and copper, lead and zinc using an Aqua Regia (ME-ICP41) method at ALS Laboratories in Canada. Samples with base metal values in excess of 1% by ICP analysis are re-run with AA46 aqua regia and atomic absorption analysis. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with National Instrument ("NI") 43-101 and industry best practices. Standards, blanks and duplicates are included approximately one every 25 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to a secondary laboratory for check assays.

About Orla Mining Ltd.

Orla is developing the Camino Rojo Oxide Gold Project, an advanced gold and silver open-pit and heap leach project, located in Zacatecas State, Central Mexico. The project is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2019 Feasibility Study entitled “Feasibility Study, NI 43-101 Technical Report on the Camino Rojo Gold Project — Municipality of Mazapil, Zacatecas, Mexico” dated June 25, 2019 is available on SEDAR at www.sedar.com under the Company’s profile as well as on Orla’s website at www.orlamining.com. An updated independent technical report for the updated Feasibility Study on the Camino Rojo Oxide Gold Project prepared in accordance with the requirements of National Instrument (“NI”) 43-101 will be available under Orla’s profile on SEDAR within 45 days of the January 11, 2021 news release, “Orla Mining Increases Gold Mineral Reserves by 54% With Updated Feasibility Study at the Camino Rojo Oxide Gold Project”. Orla also owns 100% of the Cerro Quema Project located in Panama which includes a near-term gold production scenario and various exploration targets. The Cerro Quema Project is a proposed open pit mine and gold heap leach operation. Please refer to the “Cerro Quema Project – Pre-feasibility Study on the La Pava and Quemita Oxide Gold Deposits” dated August 15, 2014, which is also available on SEDAR at www.sedar.com.

For further information, please contact:

Jason Simpson

President & Chief Executive Officer

Andrew Bradbury

Director, Investor Relations

www.orlamining.com

info@orlamining.com

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian and United States securities legislation, including, without limitation, the mineral resource and mineral reserve estimates, the expansion of the Camino Rojo oxide pit, expectations regarding the optimization of the oxide deposit and increase in mineral reserves, the expected additional material to be included in a future mine plan, and the Company’s development, as well as its objectives and strategies. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements are discussed in this news release, including without limitation, that there will be no material adverse change affecting the Company or its properties; that all required approvals, including Mexican antitrust (COFECE) approval, will be obtained; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: delays in or failure to receive Mexican antitrust (COFECE) approval, risks related to uncertainties inherent in the preparation of feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost of production, variations in quantity of mineralized material, grade or recovery rates, geotechnical or hydrogeological considerations during mining differing from what has been assumed, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, cost of labour, supplies, fuel and equipment rising, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive amended permits, including CUS, risks inherent in the estimation of mineral reserves and mineral resources, including but not limited to, risks that the interpreted drill results may not accurately represent the actual continuity of geology or grade of the deposit, bulk density measurements may not be representative, interpreted and modelled metallurgical domains may not be representative, and metallurgical recoveries may not be representative; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 23, 2020, available on www.sedar.com. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

The disclosure in this release uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council May 10, 2014, as amended (the “CIM Definition Standards”). NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the “SEC”) set forth in Industry Guide 7. Consequently, information regarding mineralization contained in this release is not comparable to similar information that would generally be disclosed by U.S. companies in accordance with the rules of the SEC. In particular, the SEC’s Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions used by the SEC in Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, mineral reserve estimates contained in this release may not qualify as “reserves” under SEC standards. In addition, this release uses the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” to comply with the reporting standards in Canada. The SEC does not currently recognize mineral resources and U.S. companies are generally not permitted to disclose mineral resources of any category in documents they file with the SEC. Investors are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves as defined in NI 43-101 or Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an inferred resource could ever be mined economically. It cannot be assumed that all or any part of “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” in this release is economically or legally mineable. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Following the transition period, as a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101. If the Company ceases to be a foreign private issuer or lose its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101. The SEC Modernization Rules include the adoption of terms describing mineral reserves and mineral resources that are “substantially similar” to the corresponding terms under the CIM Definition Standards. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definitions. U.S. investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For the above reasons, information contained in this release containing descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

[1] The Camino Rojo Mineral Resource estimate has an effective date of June 7, 2019 and was prepared using the CIM Definition. Additional information can be found in the Camino Rojo Technical Report dated June 25, 2019.

[2] The Camino Rojo Mineral Resource estimate has an effective date of June 7, 2019 and was prepared using the CIM Definition. Additional information can be found in the Camino Rojo Technical Report dated June 25, 2019.

[3] As announced on December 21, 2020, Orla completed a Layback Agreement with Fresnillo PLC (“Fresnillo”) that will allow Orla to expand the Camino Rojo oxide pit onto part of Fresnillo’s mineral concession located immediately north of Orla’s property.